You've assessed risks worth millions, settled complex claims under pressure, and navigated regulatory requirements without missing a beat.

So why does your resume blend in with every other insurance professional's?

TL;DR

- Insurance certifications (CPCU, AIC, ARM) belong prominently near the top

- Use the Midnight Professional template for a polished, corporate look

- Quantify everything: loss ratios, claim volumes, premium underwritten, accuracy rates

- Tech skills matter more than ever (Guidewire, data analytics, AI tools)

- Specialty areas (cyber risk, InsurTech) are in high demand

The Insurance Hiring Landscape (2026)

of insurance companies expanding workforce

The industry is actively hiring—especially in tech, underwriting, and claims

Source: Program Business, 2026

of insurers expecting hybrid work

Remote and flexible positions are now standard in insurance

Source: Insurance Industry Survey, 2026

median underwriter salary range

Senior underwriters and specialized roles command premiums

Source: Bureau of Labor Statistics, 2024

Digital transformation is reshaping insurance. Traditional underwriting and claims roles now require data analytics, AI fluency, and InsurTech familiarity. If you have these skills, you're in demand.

What Insurance Hiring Managers Scan For

| What They Want | How to Prove It |

|---|---|

| Risk assessment | "Underwrote $50M in annual premium with 92% retention rate" |

| Claims efficiency | "Processed 150+ claims/month with 98% accuracy, $15K average settlement" |

| Loss prevention | "Reduced loss ratio from 65% to 58% through portfolio optimization" |

| Industry certifications | CPCU, AIC, ARM, state licenses prominently displayed |

| Technology proficiency | Guidewire, Duck Creek, Xactimate, SQL, data analytics |

| Regulatory knowledge | State insurance regulations, compliance, audit experience |

Numbers matter in insurance. If you can't tell me your premium volume, loss ratio impact, or claims accuracy rate, I have to assume you don't track performance. And that's a red flag.

The Insurance Resume Structure

- 1

Header

Name, city, contact—certifications can appear here too

- 2

Professional Summary

3-4 lines: years in insurance, line of business, top metric

- 3

Certifications & Licenses

CPCU, AIC, ARM, state licenses—before or after summary

- 4

Experience

Reverse-chronological with volume, accuracy, and loss ratio metrics

- 5

Skills

Insurance-specific systems, analytics tools, regulatory knowledge

- 6

Education

Degrees, relevant coursework, ongoing CPCU/IIA education

Certification Placement

If you hold CPCU, ARM, or AIC, consider adding it after your name in the header:

"Michael Torres, CPCU, ARM"

This immediately signals your credentials before any reading begins.

Writing an Insurance Summary That Gets Noticed

What to include:

- Years of experience and line of business (P&C, Life/Health, Commercial)

- Current role level (Underwriter, Senior Claims Examiner, Manager)

- Top quantified achievement

- Specialty or niche (cyber risk, workers' comp, commercial auto)

- Certifications

Strong Insurance Summary

Senior Commercial Underwriter (CPCU, ARM) with 8+ years in middle-market commercial lines. Expert in property, casualty, and umbrella coverage with $50M annual premium authority. Maintained 58% loss ratio (10 points below portfolio average) while growing book by 18% YoY. Seeking underwriting leadership role focused on portfolio optimization.

Weak Insurance Summary

"Experienced insurance professional with strong analytical skills seeking a challenging opportunity in underwriting or claims management."

Quantifying Your Insurance Impact

For Underwriters

| Generic (Avoid) | Impact-Driven (Use This) |

|---|---|

| Reviewed insurance applications | Underwrote 200+ commercial accounts annually representing $50M in premium with 92% retention rate |

| Assessed risk | Reduced portfolio loss ratio from 65% to 58% through enhanced risk selection and pricing strategies |

| Worked with agents | Built relationships with 40+ agency partners, increasing submissions by 35% and hit ratio by 12% |

| Managed renewals | Achieved 94% renewal retention rate on $30M book of commercial property accounts |

| Handled complex accounts | Specialized in cyber liability underwriting, binding $15M in new premium with 52% loss ratio |

For Claims Adjusters

| Generic (Avoid) | Impact-Driven (Use This) |

|---|---|

| Processed insurance claims | Handled 150+ property claims monthly with 98% accuracy and $15K average settlement |

| Investigated claims | Detected $1.2M in fraudulent claims through investigation and SIU referrals |

| Worked on catastrophe claims | Deployed to 5 CAT events, settling 400+ claims with 24-hour average initial contact |

| Negotiated settlements | Negotiated 500+ bodily injury settlements with 95% closure without litigation |

| Used claims software | Expert Xactimate certification; processed 50+ property estimates weekly |

Numbers That Matter in Insurance

| Category | Examples |

|---|---|

| Premium | $50M underwritten, 18% growth, 92% retention |

| Loss ratio | 58% (10 pts below average), reduced from 65% |

| Claims volume | 150+ monthly, 400+ CAT claims |

| Accuracy | 98% claims accuracy, 95% closure without litigation |

| Fraud detection | $1.2M prevented, 50+ SIU referrals |

Skills Section for Insurance

Insurance Skills Format

Underwriting: Risk Assessment, Commercial Lines, Property & Casualty, Pricing Strategy, Loss Control, Reinsurance, Treaty Analysis

Claims: Investigation, Settlement Negotiation, Subrogation, Fraud Detection, Litigation Management, CAT Response

Technology: Guidewire PolicyCenter, Duck Creek, Xactimate, Applied Epic, Majesco, SQL, Tableau, Power BI

Regulatory: State Insurance Regulations, NAIC Compliance, Surplus Lines, E&S Markets

High-Demand Skills 🔥

- Cyber risk underwriting

- Data analytics and predictive modeling

- InsurTech and AI integration

- Climate risk assessment

- Parametric insurance products

- Telematics and IoT

Less Differentiated

- 'Strong analytical skills' (expected)

- 'Detail-oriented' (prove it with accuracy rates)

- 'Customer service focused' (show outcomes)

- Generic 'insurance experience'

Insurance Certifications That Matter

High-Value Insurance Credentials

- CPCU (Chartered Property Casualty Underwriter)

- ARM (Associate in Risk Management)

- AIC (Associate in Claims)

- AINS (Associate in General Insurance)

- CISR (Certified Insurance Service Representative)

- State Adjuster Licenses (by state)

- Xactimate Certification (for adjusters)

In-Progress Designations

Pursuing your CPCU? Include it:

"CPCU (4 of 8 exams completed, expected 2026)"

It signals ambition and ongoing professional development.

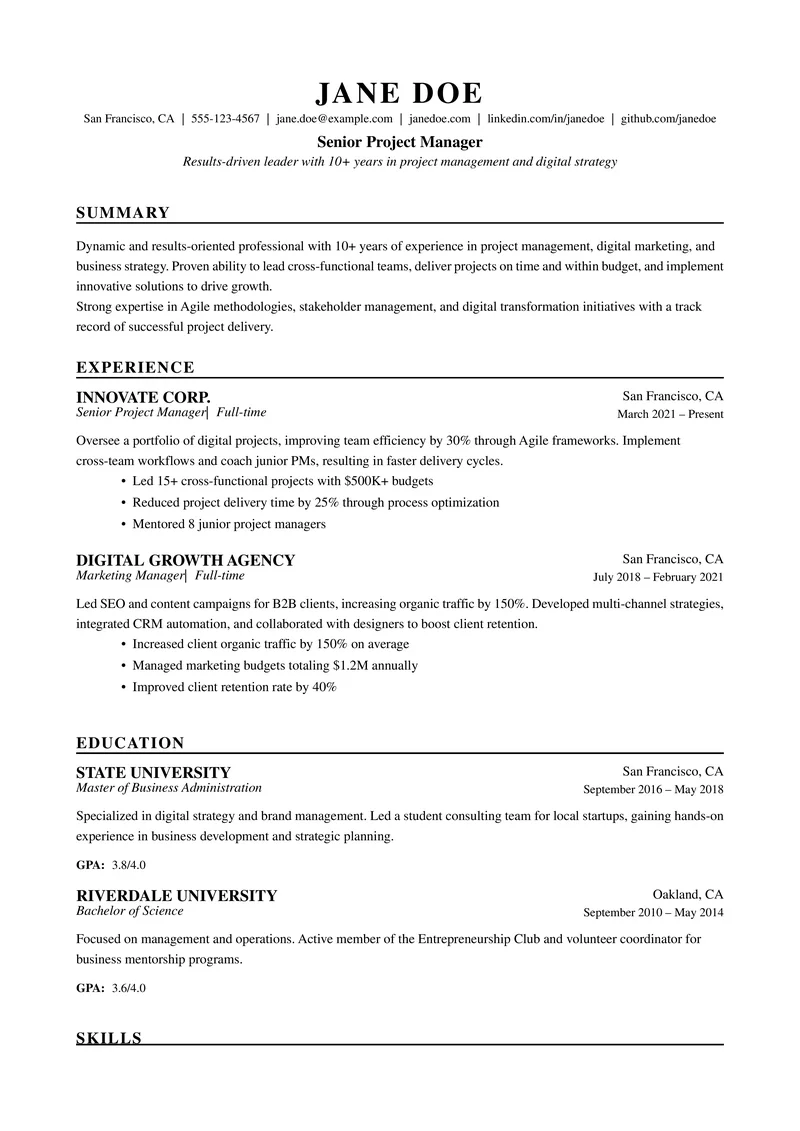

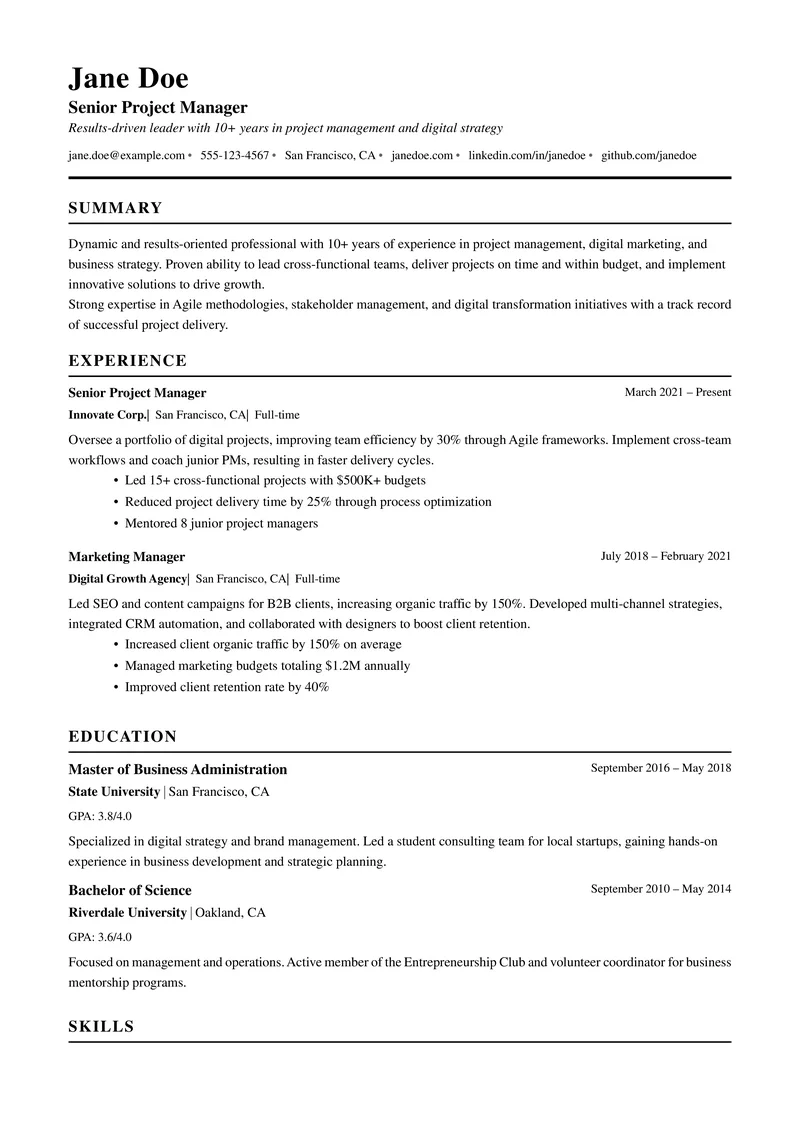

Template Selection for Insurance

The Midnight Professional Template

Polished, corporate, and perfect for insurance carriers:

Midnight Professional

2-col layout

Figure: Midnight Professional template — corporate polish for insurance roles. Use This Template

Template Recommendations

Insurance Resume Templates

Harvard Template

1-col layout

Navy & Gold Classic

1-col layout

Functional Minimal

1-col layout

Midnight Professional

2-col layout

| Template | Best For | Why |

|---|---|---|

| Midnight Professional | Underwriters, Corporate | Modern professional look |

| Classic Executive | Claims Managers, Directors | Leadership-focused |

| Harvard Template | Actuaries, Compliance | Traditional, conservative |

| Navy Gold Classic | Senior Leadership | Premium aesthetic |

Common Insurance Resume Mistakes

Instant Rejection Triggers

- No certifications listed — CPCU, AIC, ARM signal serious commitment

- Missing metrics — "Processed claims" without volume or accuracy rates

- Generic "risk assessment" claims — What line of business? What premium size?

- No technology — Guidewire, Xactimate, analytics tools are now expected

- Ignoring specialty areas — Cyber, climate risk, and InsurTech are hot

- Old license information — Ensure state licenses are current and accurately listed

Pre-Submit Checklist

Insurance Resume Audit

- Certifications listed prominently (CPCU, AIC, ARM)

- State licenses included with current status

- Premium volume or claims volume quantified

- Loss ratio or accuracy metrics stated

- Insurance systems specifically named

- Line of business specialization clear

- Clean, ATS-parseable format

Your Move

You've assessed risks, settled complex claims, and kept loss ratios in check while the industry transformed around you.

Now prove it to hiring managers who are actively looking for your skills.

Build Your Insurance Resume

Join thousands of insurance professionals using ResumeGuru to land positions at top carriers and agencies.

Create My Resume FreeRelated Resources

- Resume Summary Generator — Write compelling insurance summaries with AI

- Skills Finder Tool — Get insurance-specific keywords

- How to List Certifications — CPCU, ARM, AIC formatting guide

- Resume Examples Library — See insurance resumes in context

- Browse Professional Templates — All ATS-optimized

More Industry Resume Examples

- Software Engineer Resume Examples — Technical stack, GitHub links, quantified impact

- Sales Resume Examples — Quota attainment, CRM proficiency, methodology fit

- Legal Resume Examples — Bar admissions, case wins, specialization

- Marketing Resume Examples — ROI-focused bullets, digital skills, portfolio links

Frequently Asked Questions

What should an insurance resume include?

Risk assessment skills, industry certifications (CPCU, AIC, ARM), claims volume handled, software proficiency (Guidewire, Duck Creek), and quantified achievements like loss ratio improvements.

How do I quantify achievements on an insurance resume?

Use metrics: 'Processed 150+ claims monthly with 98% accuracy', 'Reduced loss ratio from 65% to 58%', 'Underwrote $50M in premium volume annually.'

What certifications help on an insurance resume?

CPCU (Chartered Property Casualty Underwriter), AIC (Associate in Claims), ARM (Associate in Risk Management), and state-specific adjuster licenses.

What insurance software should I list?

Guidewire, Duck Creek, Xactimate (for adjusters), Majesco, Applied Epic, and data analytics tools like SQL or Tableau.

Is insurance hiring competitive in 2026?

Yes, but there's a talent shortage in specialized areas like cyber risk, data analytics, and InsurTech. The industry is actively recruiting tech-savvy candidates.

Build Your Perfect Resume

Create an ATS-optimized resume with our AI-powered builder.

No signup required.Start Building FreeExplore Resources

Enjoyed this article?

Share it with your network